BENEFITING FROM HISTORICALLY LOW MORTGAGE RATES

THOUGHT LEADERSHIP PERSPECTIVES

BY ANDREW R. GREEN, CFP®

IF YOU HAVE NOT GIVEN SERIOUS THOUGHT TO REFINANCING OR ANALYZING HOW BORROWING AT LOW RATES MAY BENEFIT YOUR BROADER FINANCIAL SITUATION, NOW IS THE TIME.

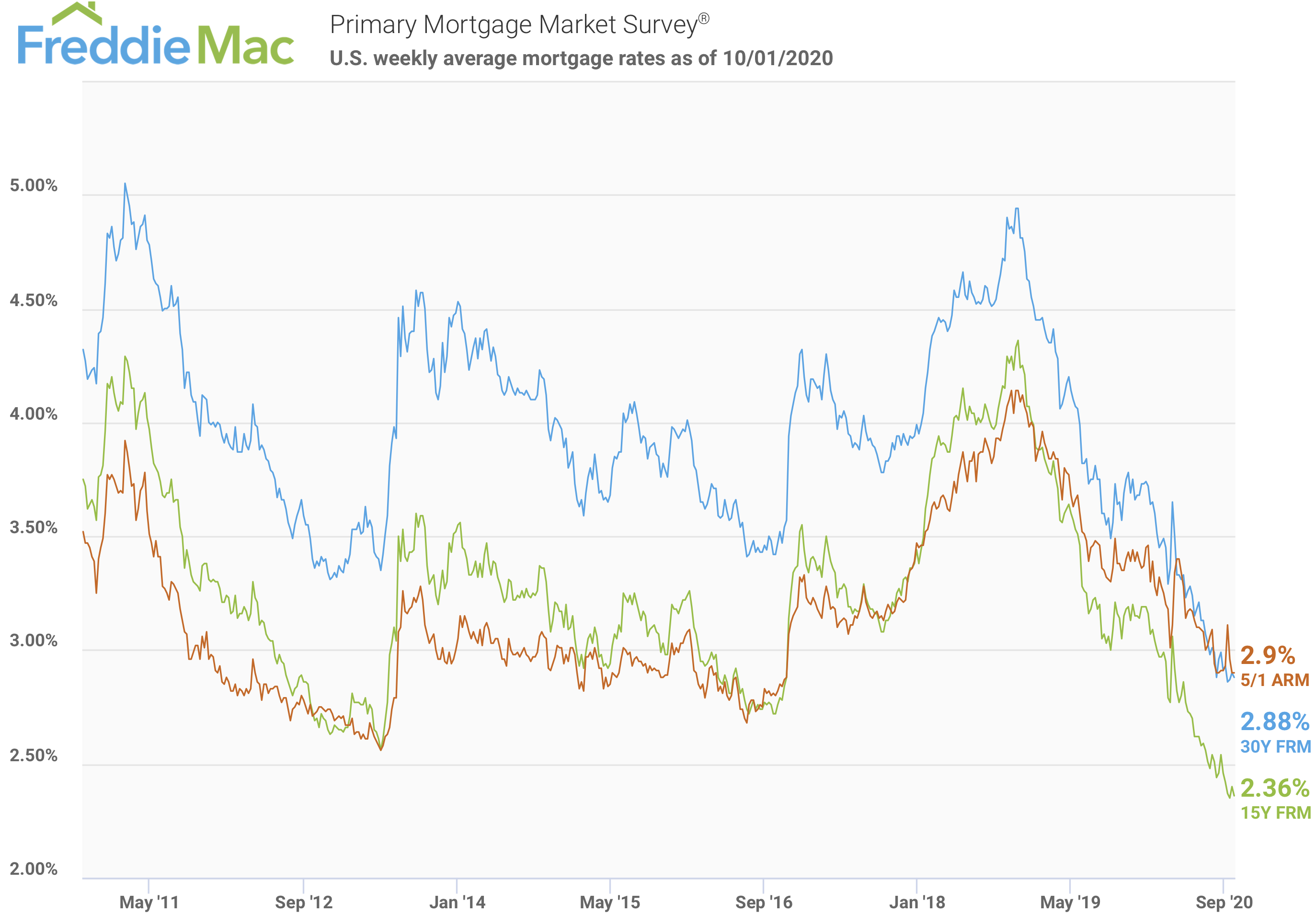

Many financial rates are at historic lows due to current conditions, market instability and high demand for safety in the form of lower volatility. Fixed income instruments like treasury bonds, corporate bonds and municipal bonds that offer relative stability within diversified portfolios no longer reward investors with 5-8% coupon payments. On the bright side however, mortgage rates are at all-time lows.

Earlier this year the Federal Reserve cut its key federal funds rate to zero. Guidance suggests that the Fed does not anticipate raising this rate for several years due to the economic impact caused by the Coronavirus pandemic. A lower Fed funds rate allows for banks to lend more inexpensively to other banks, ultimately passing along those lower rates to consumers in the form of lower rates for lines of credit, auto loans, or mortgages. The Federal Reserve’s stance, coupled with low inflation and a prolonged period of economic uncertainty, have driven mortgage rates into ‘below 3% territory’.

FOR TAXPAYERS WHO BENEFIT FROM ITEMIZING THEIR DEDUCTIONS AND UTILIZING THE MORTGAGE INTEREST DEDUCTION, THE NET TAX-EFFECTED MORTGAGE RATE CAN BE UNDER 2% ON A 30-YEAR MORTGAGE!

30-year fixed mortgage rates are down ½% from this time last year and 1 ½% when compared to 24 months ago. While this may not seem like much, consider that you will save over $160,000 in interest expense over the life of a 30-year, $800,000 mortgage when decreasing the rate from 4% to 3%. The larger the loan, the larger the potential savings.

WHAT ABOUT SECOND HOMES OR HELPING YOUR CHILDREN PURCHASE A HOME?

If you are looking to purchase a second home or even help a family member or child get that perfect house, securing a mortgage at all-time low rates instead of paying in cash or liquidating from the investment portfolio may make good financial sense.

For those with existing mortgages, consider whether refinancing is appropriate. Since closing and administrative costs of refinancing can typically be several thousand dollars, the decision is not always straightforward. Make sure the decrease in rate is substantial enough to warrant paying these costs. Since it may take several years for the rate savings to eclipse the amount paid in closing costs, refinancing may not make sense if you plan to sell the home in the near-term. For homeowners already far into the life of their mortgage, monthly payments are much more heavily skewed toward principal, instead of interest, making the decision to refinance less clear. Here it may be worth considering adjusting loan terms as part of a refinancing, for example moving from a 30-year term to a 15-year term. Similarly, now may be the perfect time to refinance an adjustable rate mortgage (ARM) or balloon mortgage to lock in a low rate and fixed term period.

DO HISTORIC LOW RATES APPLY TO HOME EQUITY LOANS AS WELL?

Home equity loans or lines of credit allow homeowners to use the existing equity in their homes as collateral to borrow against. Rates for these products can be fixed or variable and often depend on key benchmark rates such as LIBOR or federal funds rate. As with mortgages, current home equity rates remain low and generally attractive. While a home is used as collateral for the loan, the proceeds can typically be used for anything. Consider paying down higher rate debt, such as auto loans, student loans or even credit cards with a low rate home equity loan or line of credit.

WHAT ELSE MIGHT A CONSIDER?

Lastly, think outside the box. Give thought to non-traditional borrowing such as a pledged asset line of credit whereby securities such as mutual funds, stocks and bonds are used as collateral. The account holder still maintains ownership of the securities, but the lender has the ability to call a pledged asset loan at any time, require additional deposits or sales of assets if account values fall below thresholds and has recourse to take ownership if the borrower defaults. Similar to home equity lines of credit, pledged asset lines can be used for a wide variety of purposes and can offer very attractive low rates. In times of significant market downturn, drawing from a pledged asset line for liquidity can be more advantageous than liquidating the portfolio holdings at depressed levels which would otherwise turn a paper loss into a real loss.