IRS ANNUAL INFLATION ADJUSTMENTS

THOUGHT LEADERSHIP PERSPECTIVES

BY ERIONA HOWARD, CPA, EA, MST

THE IRS RECENTLY ANNOUNCED ANNUAL INFLATION ADJUSTMENTS TO SEVERAL TAX PROVISIONS FOR TAX YEAR 2023. THESE CHANGES ARE APPLICABLE TO RETURNS THAT WILL BE FILED IN YEAR 2024.

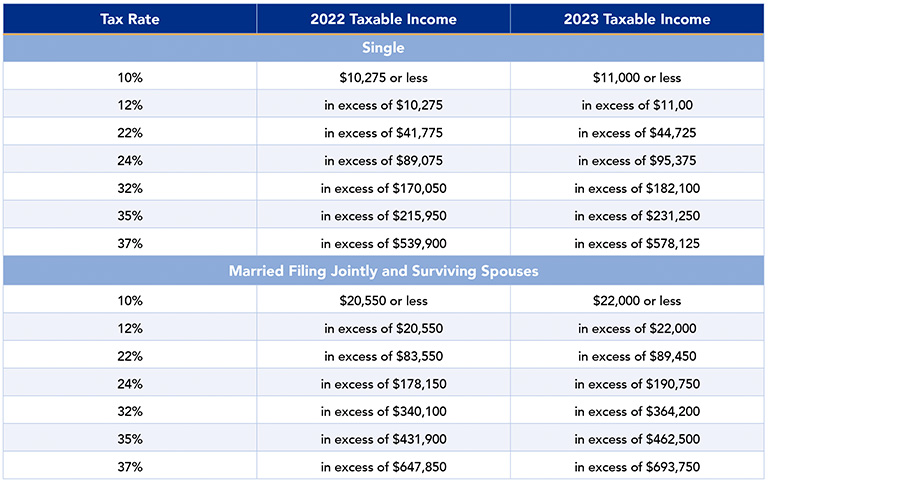

It is important to know how changes in the tax rates and taxable income thresholds affect your personal situation. The most notable changes are listed below for single and married filing jointly filers and estates and trusts, in comparison to tax year 2022.

Individual Federal Tax Rates

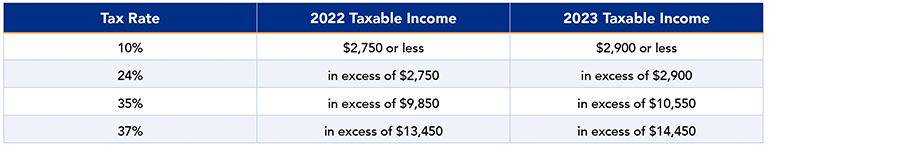

Estates and Trusts Federal Tax Rates

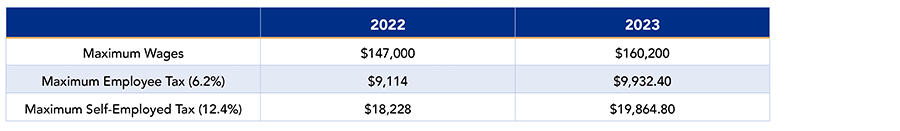

Standard Deduction, Social Security, and Gift Exclusions

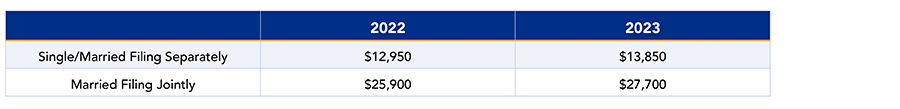

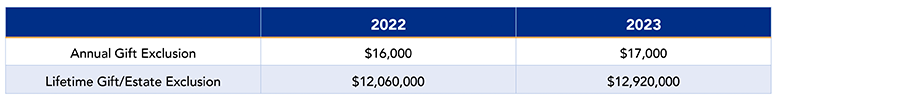

The standard deduction, annual gift exclusion, and lifetime gift and estate exclusion amounts all increase in 2023, as reflected below. The Social Security Administration (SSA) also announced similar inflation adjusted amounts to the maximum social security wages and tax.

Standard Deduction

Social Security Tax

Gift Exclusions

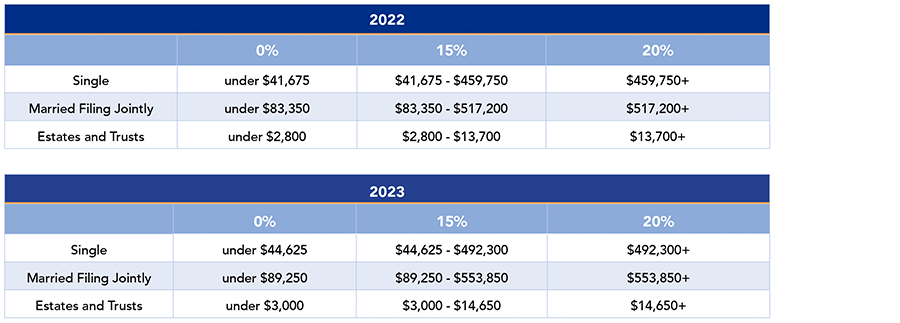

Long-Term Capital Gains and Qualified Dividends Tax Rates By Taxable Income

The long-term capital gains and qualified dividends taxable income thresholds are also increased from 2022. In 2023 those thresholds increase by $2,950 to $44,625 for single filers ($89,250 for married filing jointly filers).

The single taxpayer’s long-term capital gains and qualified dividends income can escape taxation entirely at a 0% tax rate if taxable income is below the $44,625 threshold ($89,250 for married filing jointly filers).

On the other hand, estates and trusts are subject to a 15% tax on long-term capital gains and qualified dividends after taxable income reaches just $3,000 in 2023, up $200 from 2022.

Additional Adjustments For 2023 Tax Year Worth Mentioning

-

The Flexible Spending Arrangement (FSA) amount increases by $200 to $3,050. For cafeteria plans that allow carryover amounts, the maximum carryover amount increases by $40 to $610.

-

The Health Savings Account (HSA) contribution amount increases by $200 (self-coverage) and $450 (family coverage) to $3,850 and $7,750, respectively.

-

The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan increases by $2,000 to $22,500 and the catch-up contribution limit for employees age 50 and over increases to $7,500, up from $6,500.

-

The Defined Contribution Plan limit increases by $5,000 to $66,000.

-

The limit on annual IRA contributions increases by $500 to $6,500; however, the IRA catch-up contribution limit for individuals age 50 and over remains the same at $1,000.

-

The income threshold for Sec.199A, Qualified Business Income, increases by $12,050 for single filers, to $182,100 in 2023 ($364,200 for married filing jointly filers).

-

The foreign earned income inclusion amount increases by $8,000 to $120,000.

Rev. Proc. 2022-38 and Notice 2022-55 provide further details about these annual adjustments.