CONSIDER A DONOR ADVISED FUND AS YOUR VEHICLE OF CHOICE FOR CHARITABLE GIVING

THOUGHT LEADERSHIP PERSPECTIVES

BY KELLEY TAYLOR, CFP®

With the 2018 tax law changes, many individuals may find themselves no longer in a position to itemize deductions.

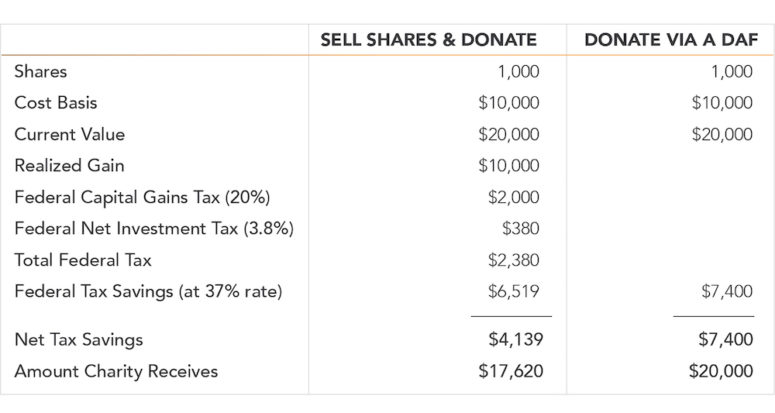

COMPARE BOTH APPROACHES

If you have appreciated securities, held for longer than twelve months, donating them to the Donor Advised Fund (DAF) can increase both your tax savings and the amount that the charity receives. Using the DAF streamlines the giving process, saves an incremental $3,261 in taxes, AND allows the charity to receive the full cash benefit!

5 BIG BENEFITS OF DONOR ADVISED FUNDS

CHARITABLE DEDUCTION BUNCHING

In the current tax environment, one way to take the most advantage of the charitable deduction may be to “bunch” donations into one year. With DAFs you can donate larger amounts of cash/securities to the fund every few years to fully take advantage of the charitable deduction in the years that it makes the most sense. You may wish to make higher charitable contributions in years that you have experienced larger bonuses or stock vesting. You can then make a grant to the specific charities you would like to support over time.

LOW COST STOCK DONATION

Assume you have a security that you have held for month than twelve months with a large unrealized gain. You could sell the security, and pay up to 20% federal capital gains tax, potentially be subject to additional Net Investment Income tax of 3.8%, and also pay any applicable state taxes. Instead, you could donate the security directly to charity and pay no capital gains tax.

LEGACY PLANNING

Many families have charitable intentions. Some custodians allow donors to appoint successors to manage the DAF at their death. Many sponsor platforms also allow multiple account users so that multiple family members can participate in grants from the fund. Custodians also offer a broad range of investment options so that donors can invest the money within the charitable account. Utilizing these tools can allow the account to grow and enhance the opportunity to be a “legacy” vehicle. This can be a great platform for parents to involve their children in the family giving strategy.

LOW MINIMUMS

DAFs are available through many different custodians. Account minimums are as low as $5,000 at some institutions.

ADMINISTRATIVE EASE

Unlike a foundation, a DAF has no additional filing requirements. The plan custodian handles all administrative functions, such as ensuring charities are legitimate 501(c)(3) organizations and sending the money directly to the donor’s charity of choice. Donors can make grants online and the custodian will handle verifying the charity and sending the funds.

If the DAF and the assets being donated are at the same custodian, the donation can usually be processed in just a few days. Sending assets directly to the charity can take weeks or even months.

DAFs can help streamline family giving. If all donations are made directly from the DAF, there is no more going through the checkbook to remember if and when you made your annual donations.

WHAT IS A DONOR ADVISED FUND?

A Donor Advised Fund is an account that is established for charitable purposes. These accounts can be set up in the name of an individual or in the name of a family. Donors can fund the account with cash, securities, or appreciated assets and make grants to their charities of choice over time. Traditionally, individual stocks, mutual funds, and ETFs are used to fund a DAF. Under certain circumstances, assets such as real estate, private equity, and closely held business interests may also be eligible.

The charitable deduction is claimed in the year in which the assets are irrevocably transferred to the DAF, even if the final charities have not received the benefit in the same year. For example, an individual can donate $10,000 to a DAF in 2018 and then distribute $2,000/year over the next 5 years to the charity of their choice (school, religious institution, etc.). The entire $10,000 deduction would be taken on the 2018 tax return.

DAF sponsors—which include many major financial institutions such as Fidelity, Schwab, and Vanguard—handle all of the administrative functions of the account. The institutions do everything from holding the assets, to ensuring recipients are legitimate charities, to processing the grants to the specific charities. Most platforms are easy to use and you can make grants from your DAF directly to your charity of choice online.

IF YOU’D LIKE TO SPEAK WITH SOMEONE AT FAIRMAN GROUP FAMILY OFFICE ABOUT DONOR ADVISED FUNDS, PLEASE CONTACT US .